If the contents of the succession are uncertain or unknown, each heir can request that an inventory of the estate be drawn up. There are 2 types: the public inventory and the precautionary inventory.

Public inventory

If the contents of the estate are uncertain or unknown, each heir may request, within one month of the death or knowledge of heirship, that a public inventory be established. This allows the assets and liabilities of the estate to be ascertained, including the amount of any debts, by calling on any creditors by means of public notices.

The decision to make a public inventory is communicated to all the heirs. Once the inventory has been drawn up, its contents are communicated to all the heirs by the notary.

Depending on the results of the inventory, you may choose to accept the inheritance subject to public inventory. This option is open to all heirs, who can then limit their liability to the contents of the inventory. This means that only the debts listed in the inventory can be charged to the heirs who must pay them.

You always have the choice of accepting the inheritance without reservation, refusing it, or requesting its official liquidation.

The request for an inventory suspends the legal deadlines : the debts of the estate cannot be sued, and any lawsuits in progress are suspended.

Steps to request a public inventory:

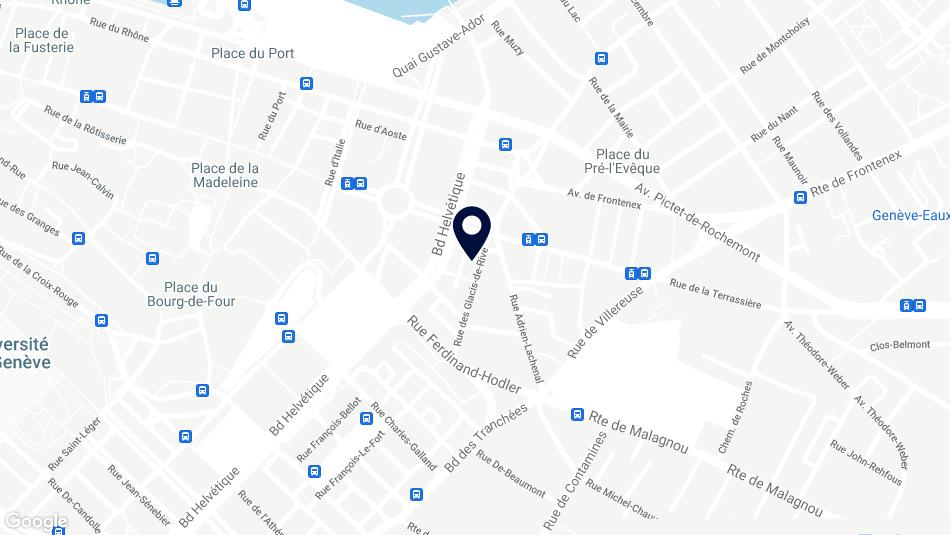

- Send your request to the court or to the Greffe universel, within one month of the death or the knowledge of your status as heir. The request must contain: your name and contact information, the name of the deceased, your relationship to the deceased or your presence in his/her will, as well as the name of a Geneva notary who will be responsible for drawing up the inventory.

- Date and sign your request by hand.

- After receiving the request, you will be asked to pay a deposit of Fr. 4'800.- to cover the costs of the procedure and the notary's fees.

- The inventory is established by a notary in Geneva of your choice. The expenses related to his/her activity are advanced by the applicant who will be reimbursed by the estate if the assets of the latter are sufficient.

Once the court has notified you of the completion of the inventory, each heir has one month to inform the Court in writing of his decision (accept it with no reservation, accept it subject to a public inventory, renounce it or request the official liquidation of the estate).

After this period and without any further action on your part, you are considered to have accepted the inheritance subject to a public inventory.

Precautionary Inventory

Alternatively, each heir may request the establishment of a precautionary inventory within 3 months following the death or the knowledge of the heir's status. This inventory is carried out by a notary and is based on his/her research as well as on the elements given by the heirs. In this case, there is no public notice.

The decision to draw up a precautionary inventory is communicated to all the heirs. Once the inventory has been made, its contents are also communicated to all the heirs by the notary.

Contrary to the public inventory, the precautionary inventory does not offer the possibility of limiting the heir's liability to the debts mentioned in the inventory. If you accept the estate with no reservation following the precautionary inventory, and additional debts are subsequently discovered, you will be liable for them.

Steps to request a precautionary inventory:

- Send your request to the court or to the Greffe universel, within 3 months of the death or the knowledge of your status as heir. The request must contain: your name and contact information, the name of the deceased, your relationship to the deceased or your presence in his/her will, as well as the name of a Geneva notary who will be responsible for drawing up the inventory.

- Date and sign your request by hand.

- After receiving the request, you will be asked to pay a deposit of Fr. 3'800.- to cover the costs of the procedure and the notary's fees.

- The inventory is established by a notary in Geneva of your choice. The expenses related to his/her activity are advanced by the applicant, who will be reimbursed by the estate if the assets of the latter are sufficient.

Once the court has notified you of the completion of the inventory, each heir has 3 months to inform the Court in writing of his/her decision (accept it with no reservation, renounce it or request the official liquidation of the estate).

After this period and without any further action on your part, you are considered to have accepted the inheritance without reservation.