Step 1: Submit your application

The creditor must submit the application in writing and send it to the Court of First Instance by post or by handing it at the court counter or the greffe universel, in duplicate. It must be written in French and signed.

Documents to be attached (in duplicate):

- The summons for payment (front and back),

- The bankruptcy warning,

- Any document useful in the event of bankruptcy without prior debt enforcement proceedings (unpaid invoices, extract from the debt enforcement register, proof that the debtor cannot be found, etc.).

The creditor may act on his/her own behalf or with the assistance of a solicitor.

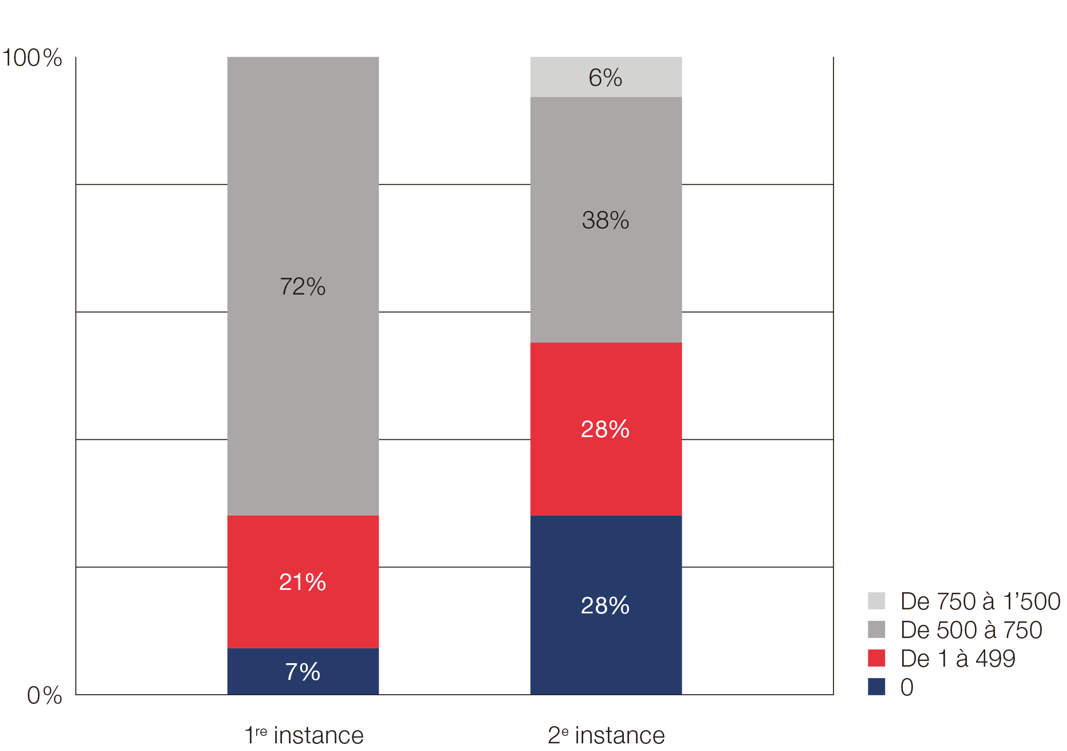

Step 2: Pay an advance on costs

You will be asked to pay an advance on costs. The amount depends on the amount of the claim (Art. 48 FeeO-DEBA).

For ordinary bankruptcies (Art. 159 DEBA):

• Up to CHF 1'000.-: CHF 40.- to CHF 150.-

• From CHF 1'001.- to CHF 10'000.-: CHF 50.- to CHF 300.-

• Over CHF 10’000: CHF 60.- to CHF 500.-

For bankruptcies without prior debt enforcement proceedings (Art. 190 DEBA):

• Up to CHF 10'000.-: CHF 50.- to CHF 300.-

• Over CHF 10’000: CHF 60.- to CHF 500.-

If you do not have the necessary financial resources, you can apply legal aid.

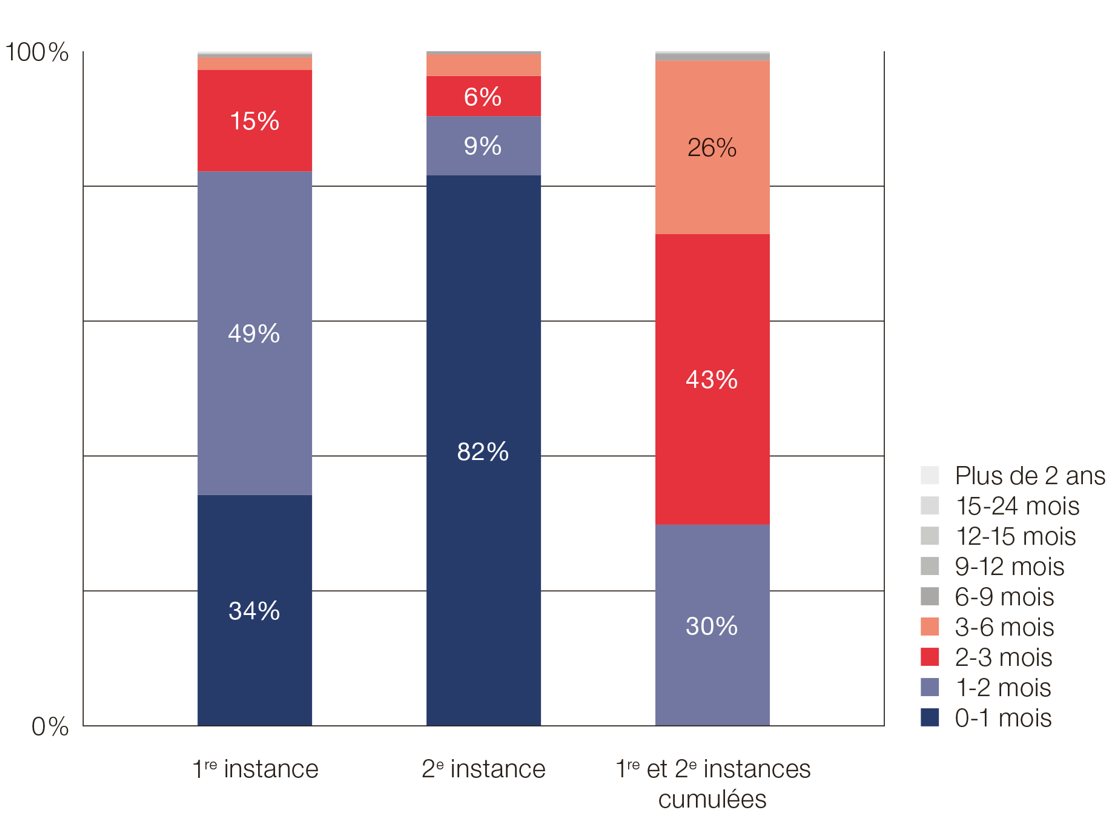

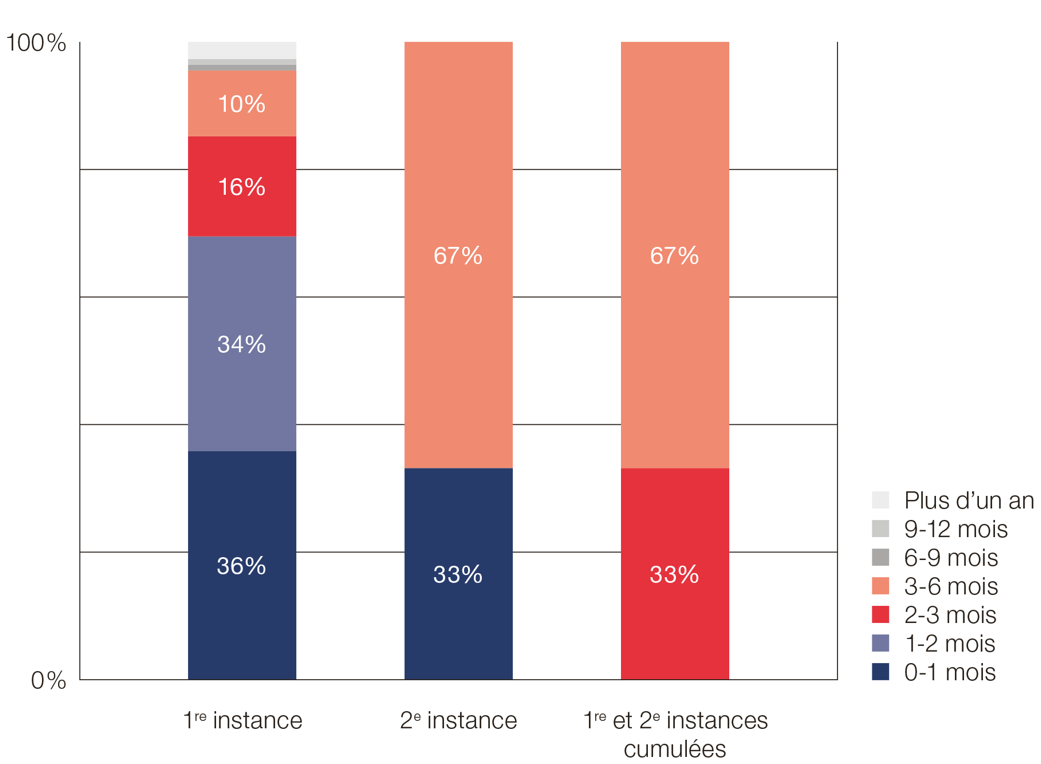

Step 3: Hearing

As a general rule, the Court of First Instance summons both parties to a hearing (oral proceedings).

The debtor may act on his/her own behalf or with the assistance of a solicitor.

At the end of the hearing, the court issues its decision.

Step 4: notification of the decision

The decision will be sent to you by post or via your solicitor (lawyer).